![Nike, Inc., Problem - Inc., Problem ... Working capital b. Current ratio ... Dell Inc. Computer, Inc. Sales (net) $57,420 $24,006 Cost of sales _____44,904 15,852 - [PDF Document] Nike, Inc., Problem - Inc., Problem ... Working capital b. Current ratio ... Dell Inc. Computer, Inc. Sales (net) $57,420 $24,006 Cost of sales _____44,904 15,852 - [PDF Document]](https://demo.vdocument.in/img/378x509/reader019/reader/2020032711/5a84fc427f8b9a882e8bea99/r-1.jpg)

Nike, Inc., Problem - Inc., Problem ... Working capital b. Current ratio ... Dell Inc. Computer, Inc. Sales (net) $57,420 $24,006 Cost of sales _____44,904 15,852 - [PDF Document]

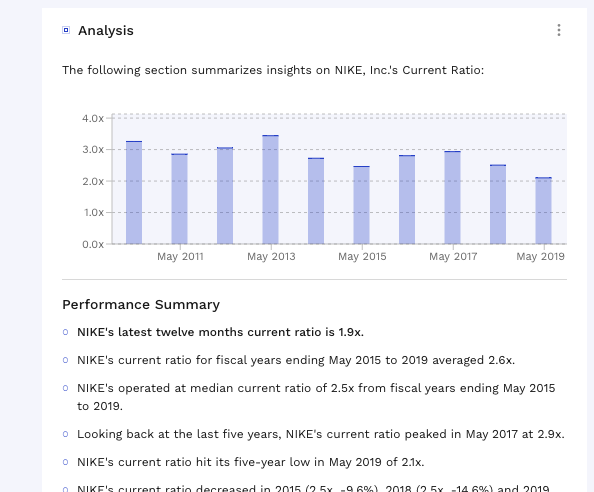

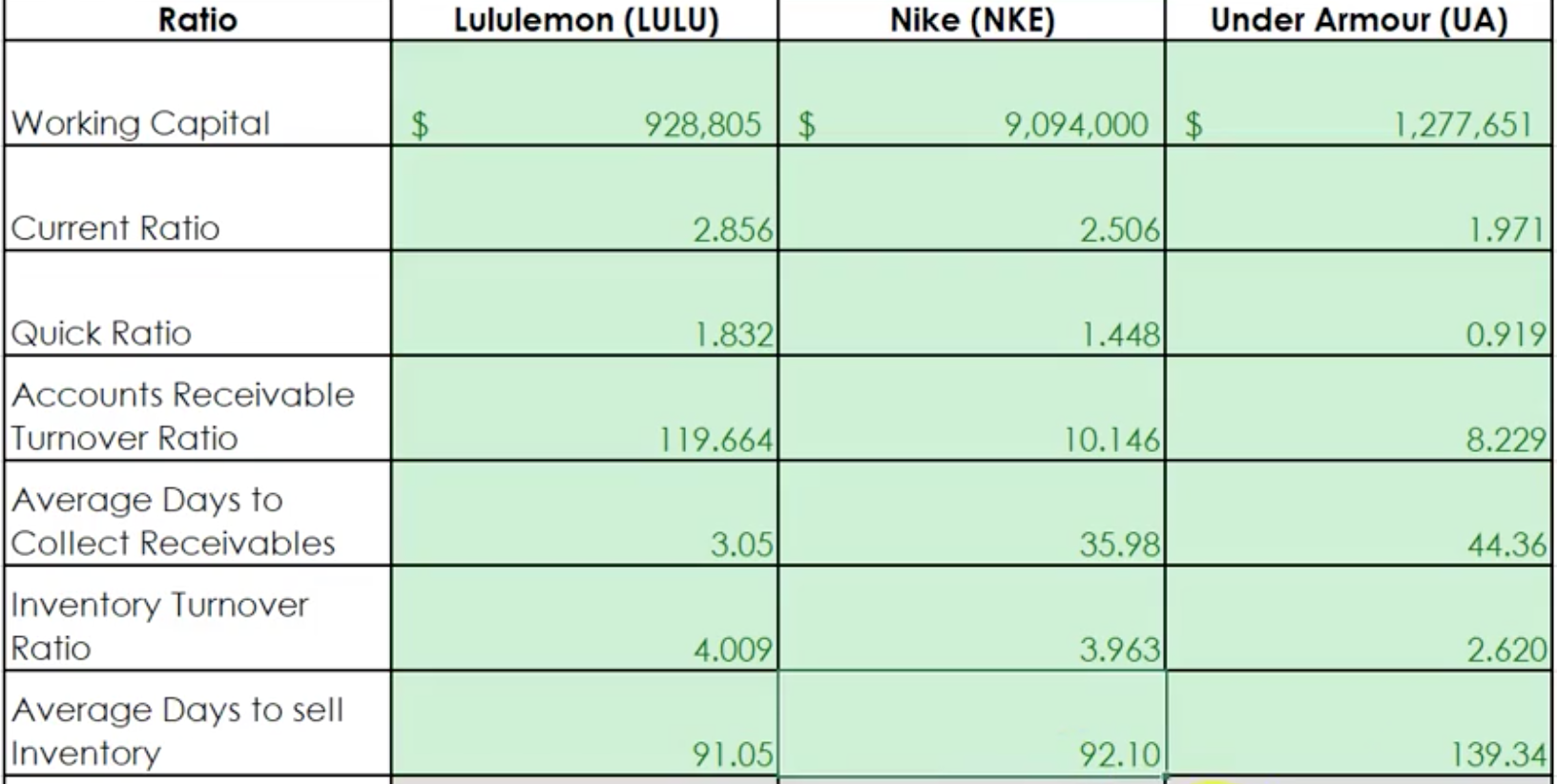

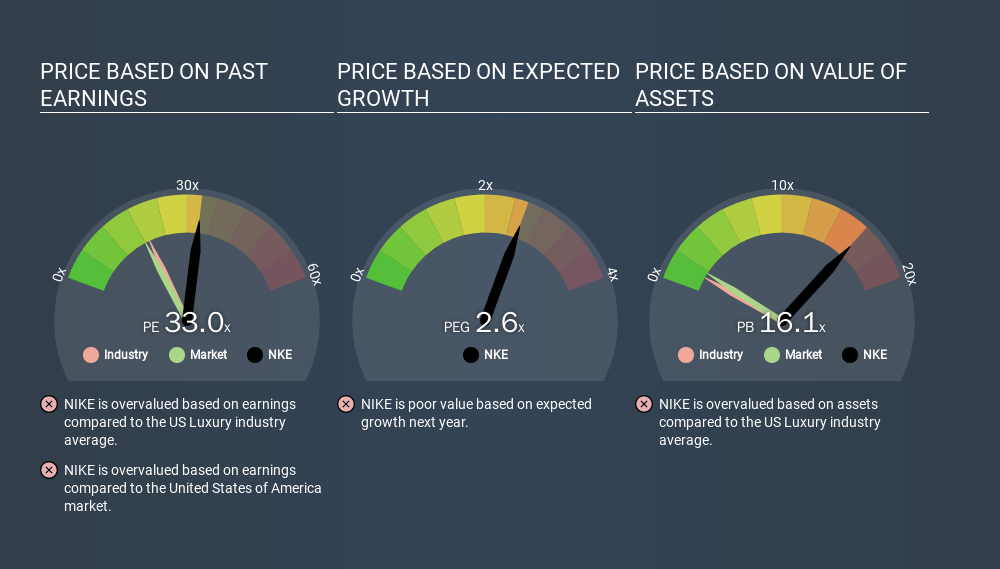

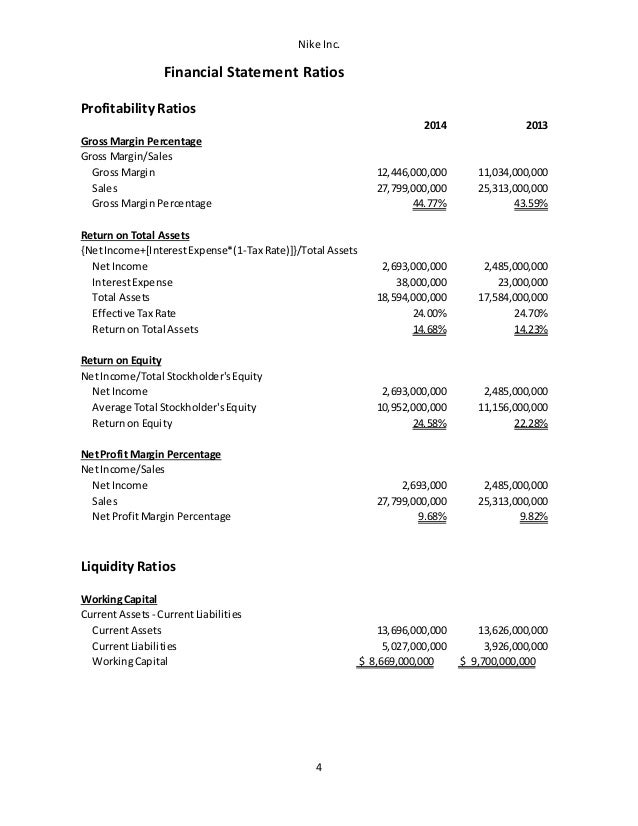

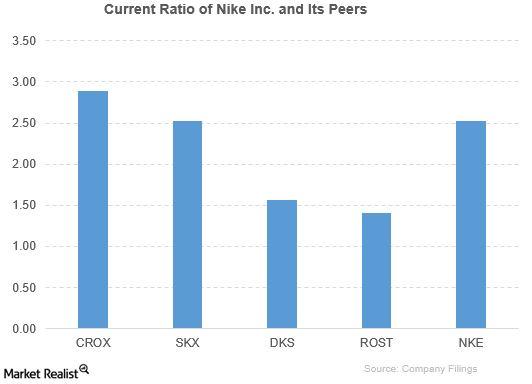

Analysis of Nike in Financial Reporting and Analysis Tutorial 31 December 2021 - Learn Analysis of Nike in Financial Reporting and Analysis Tutorial (12530) | Wisdom Jobs India